About the Company:

About the Company:

Fabtech Technologies Ltd is a global company headquartered in India, specializing in turnkey engineering solutions for pharmaceuticals, biotech and healthcare companies.

Company’s footprint spans more than 62 countries Middle East, Africa, Asia, Europe, Latin America, North America, etc. Our Company has presence across some of the key emerging economies like Bangladesh, Egypt, Ethiopia, India, Kenya, Kingdom of Saudi Arabia, Morocco, Nicaragua, Nigeria, South Africa, Turkey, UAE, USA and Tanzania. .

Company provides extensive technical expertise and infrastructure to deliver comprehensive solutions for establishing aseptic manufacturing facilities, encompassing everything from design to certification.

Company offers comprehensive start to finish services in greenfield projects, encompassing disease identification, planning, designing, engineering, procurement, quality assurance, logistics management and installation and commissioning for a wide range of customers across various geographies, particularly key emerging economies.

Additionally, Company also offers some of our engineering solutions, which majorly include, equipment procurement and supply and logistics management,on a standalone basis, either as part of greenfield or brownfield projects.

Over the years, Company has evolved beyond cleanroom and controlled environment design and construction to become a comprehensive turnkey engineering solutions provider for pharmaceuticals, biotechnology, and healthcare industries

Company’s Background:

Company is a part of Fabtech Group which was established in 1995 and have over twenty-nine (29) years of operating history in executing pharmaceutical turnkey projects. Our Company, Fabtech Technologies Limited, was incorporated in 2018 as Globeroute Ventures Private Limited.

Company’s Order Book:

As at July 31, 2025 the value of the ongoing projects forming part of our order book aggregate to Rs.904.41 crores, which shall be executed by our Company over a period of two to three years.

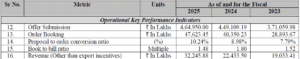

Company’s Key Operational Parameters:

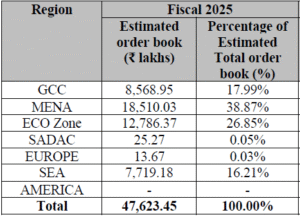

Region-wise break-up of orders received:

Management Team:

- Mr. Naushad Alimohmed Panjwani (Designation: Chairman and Independent Director)

- Mr. Hemant Mohan Anavkar (Designation: Executive Director)

Objectives of the Issue:

Fresh Issue: (Rs.230 cr)

- Funding working capital requirements of our Company.

- Pursuing inorganic growth initiatives through acquisitions.

- General Corporate Purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding working capital requirements of our Company | 127 cr |

| Pursuing inorganic growth initiatives through acquisitions | 30 cr |

Peer Group Comparison:

There are no listed companies in India that are of comparable size, from the same industry and with similar business model as that of our Company. Our Company is engaged in the business of building pharmaceutical, biotech and healthcare capabilities by offering comprehensive start to finish solutions in respect of select pharmaceutical equipment for a wide range of customers.

Positives for the Company:

Company is Pursuing inorganic growth initiatives through acquisitions.

- Company intends to pursue inorganic growth initiatives through strategic acquisition by acquiring manufacturers engaged in manufacturing of process equipment and other critical components, in India, United Arab Emirates, Saudi Arabia and Egypt.

- These acquisitions are aimed at expanding our execution capabilities, diversifying customer base, enabling operational integration with our business, cost and process optimization, streamlining business processes, expand geographic reach and gaining further market share.

- Accordingly, Company propose to utilize Rs.30 crores from the Net Proceeds towards funding acquisition of four to five target companies engaged in manufacturing of process equipment and other critical components, out of which majority of the Net Proceeds shall be utilized towards funding acquisitions in foreign geographies.

A key turnkey engineering solution provider offering integrated engineering solutions with comprehensive service offerings.

- Company is a key turnkey engineering solution provider in pharmaceuticals capex space, offering comprehensive start to finish solutions encompassing designing, engineering, procurement, installation and testing of pharmaceutical equipment for a wide range of customers.

- Company provides comprehensive start to finish execution of controlled environment infrastructure with the ability to provide end to end solution encompassing designing, engineering, procurement, installation, testing, commissioning, management and operational support for a wide range of customers primarily in the pharmaceutical, biotechnological, and healthcare sectors across geographies.

Company operates on Asset-light and integrated business model.

- Company has adopted what we believe to be a scalable, asset-light and less capital-intensive business model by procuring equipment from our Related Entities and third party equipment suppliers.

- Since, we procure majority of the equipment required by our customers through our Related Entities, on an arms-length basis and third party equipment suppliers we are not required to make capital investment for setting up a manufacturing unit or heavy machinery for manufacturing the equipment supplied by us.

- Company believes that this asset light business model, enables us to direct all our efforts towards project execution and sales and marketing activities, while ensuring that the equipment supplied to our customers are of desired quality and delivered in a timely manner. Sourcing of equipment through our Related Entities also provides us the requisite control over the cost of equipment.

Diversified order book across geographies, clients, and business verticals.

- Over the last three years, Company has expanded and diversified our order book, reflecting our commitment to organic and sustainable growth while pursuing a broader range of projects. Company’s order book has grown from Rs.424.6 crores as of March 31, 2023 to Rs.613.06 crores as of March 31, 2024 and Rs.761.7 crores as of March 31, 2025.

Pursuing inorganic growth through acquisitions in India, United Arab Emirates, Saudi Arabia and Egypt.

- Company intends to expand our integrated operations by continue building an integrated supplier base in India, United Arab Emirates, Saudi Arabia and Egypt, to ensure timely delivery of equipment, quality control through trusted procurement sources and cost effectiveness by reducing logistical costs.

- Company believes that by enhancing our operational efficiencies, we shall be able to achieve economies of scale, better absorb our fixed costs, reduce our other operating costs and strengthen our competitive position.

- In line with the aforementioned strategy, company intends to utilise an amount of Rs.30 crores from the Net Proceeds towards funding acquisition of four to five target companies engaged in manufacturing of process equipment and other critical components, out of which majority of the Net Proceeds shall be utilized towards funding acquisitions in foreign geographies.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 199.91 | 230.60 | 335.94 |

| Net Profit | 21.73 | 27.21 | 46.45 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 29th September 2025 |

| Issue Closes on | 1st October 2025 |

| Issue Price | Rs.181-191 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 75 Shares |

| Minimum Investment | Rs.14,325 |

| Issue Constitutes | 27.13% |

| Issue Size | Rs.230 cr ($ 25 million) |

| Market Cap | Rs.849.03 cr ($ 95 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 1,20,60,000 (Rs.230 cr) |

| Equity Shares Prior to the Issue | 3,23,92,239 |

| Equity Shares after the Issue | 4,44,52,239 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 14.34 | 13.31 | 26.83% | 53.44 | 0.32 |

Important Dates:

| Finalization of Basis of Allotment | on or Before 3rd October 2025 |

| Initiation of Refunds | on or Before 6th October 2025 |

| Credit of Equity Shares: | on or Before 6th October 2025 |

| Listing Date: | on or Before 7th October 2025 |

| Company Contact Info: |

|---|

| Fabtech Technologies Ltd 1st Floor, ABR Emerald, Plot No D8, Street 16, MIDC Andheri East, Chakala MIDC, Mumbai – 400 093, Maharashtra, India. Telephone: +91 226554 0300 Email: cs@fabtechnologies.com Website: www.fabtechnologies.com |

| Registrar to the Issue: |

|---|

| Bigshare Services Private Limited S6-2, 6th Floor, Pinnacle Business Park, Next to Ahura Center, Mahakali Caves Road, Andheri East, Mumbai-400 093, Maharashtra, India. Telephone: +91 226 263 8200 Email: ipo@bigshareonline.com Website: https://www.bigshareonline.com |

| Check IPO Allotment Status: |

|---|

Bigshare: http://www.bigshareonline.com/IPO/Allotment

|