About the Company:

About the Company:

Ganesh Consumer Products Ltd is a FMCG company headquartered in Kolkata, West Bengal and in terms of value sold in Fiscal 2025, company is the third largest brand of packaged whole wheat flour (atta) and largest brand in wheat-based derivatives (maida, sooji, dalia) in East India.

Company is also one of the top two players for packaged sattu and besan (which are gram-based flour products) with a share ~43.4% (sattu) and ~4.9% (besan) in East India market for respective products, with a growing presence in various consumer staple categories such as spices and ethnic snacks.

In West Bengal our Company has a share of approximately 40.5% by value sold in Fiscal 2025 for wheat-based products including wheat flour, maida, sooji and dalia.

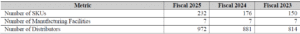

As on March 31,2025, we service our general trade channel with over 28 C&F agents, 9 super stockists and 972 distributors. As on March 31, 2025, company’s product portfolio comprises of 42 products with 232 SKUs across our various product categories.

Company’s products are sold under our flagship brand “Ganesh”, which serves as our primary identity in the market.

Company has seven manufacturing facilities strategically located spread across the states of West Bengal, Uttar Pradesh and Telangana.

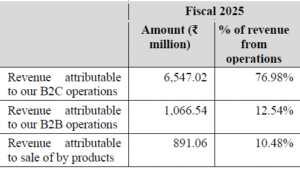

Company’s business is primarily driven by business-to-consumer (B2C) operations, which contributes 76.98% of revenues in the last Fiscal 2025.

Company’s Products:

Company offer a range of consumer staples comprising of (i) whole wheat flour (atta), (ii) wheat and gram-based value-added flour products (including, refined wheat flour (maida), semolina flour (sooji), roasted gram flour (sattu), gram flour (besan), cracked wheat (dalia) amongst others) and (iii) other emerging food products including packaged instant food mixes (such as khaman dhokla and bela kachori), spices (whole, CTC powder (chilli, turmeric and coriander) and blended), ethnic snacks (such as (including bhujia and chanachur) and ethnic flours such as singhara flour, pearl millet (bajri) flour, etc.

Company’s Revenue from B2B and B2C Segments:

Company’s Distribution Networks:

Company has developed an omni-channel presence through our general trade channels, modern trade channels and e-commerce channels. As on March 31, 2025, we service our general trade channel with over 28 C&F agents, 9 super stockists and 972 distributors, catering to over 70,000 retail outlets.

Company’s network in the general trade channel is spread over the states of West Bengal, Jharkhand, Bihar, Odisha and Assam.

Company’s Operational Key Performance Indicators:

Competition in the Industry:

Company face intense competition in the packaged staples food industry from various companies in India.

Some of the key peers include Adani Wilmar Ltd, Mehrotra Consumers Products Pvt Ltd, Sresta Natural Bioproducts Private Limited, Victoria Foods Pvt Ltd, Patanjali Foods Ltd, ITC Ltd, General Mills Pvt Ltd, and Baba Food Processing (India) Ltd.

Management Team:

- Mr.Manish Mimani (Designation: Chairperson and Managing Director)

- Ms. Madhu Mimani (Designation: Non-Executive Director)

Objectives of the Issue:

Offer For Sale: (Rs.278.8 cr)

- Company will not receive any proceeds from the Offer for Sale. The Selling Shareholders will be entitled to their respective portion of proceeds of the Offer for Sale.

Fresh Issue: (Rs.130 cr)

- Prepayment and/or repayment of all or a portion of certain outstanding borrowings availed by our Company;

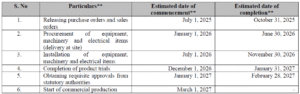

- Funding capital expenditure for the setting up of a roasted gram flour and gram flour manufacturing unit in Darjeeling, West Bengal.

- General corporate purposes.

Proposed schedule of implementation of the Sattu and Besan Unit:

Positives for the Company:

One of the Largest brand of packaged flour in East India.

- In terms of value sold, company is one of the largest brand of wheat-based and gram-based derivatives in East India in Fiscal 2025 accounting for approximately 12.6% of the East India market share for packaged wheat and gram-based products.

- In addition, company is the third largest brand in terms of value sold in Fiscal 2025, of packaged wheat flour in East India, with a share of approximately 8%.

- Further, in terms of market share by value sold in Fiscal 2025, we are the largest player for packaged sooji, dalia, and maida (which are wheat-based flour products) in East India with a market share of 31.2% (sooji and dalia), 16.4% (maida) in East India market for respective products.

- In terms of market share, company is one of the top two players for packaged sattu and besan (which are gram-based flour products) in East India with a share approximately 43.4% (sattu) and 4.9% (besan) in East India market for respective products in Fiscal 2025 by value.

Well-established and widespread multichannel distributor network and customer reach.

- Over the years, Company has developed a wide multichannel customer / distributor network comprising our general trade channels, modern trade channels and e-commerce channels of our B2C operations.

- Company’s distributor network has enabled us in creating a significant customer base in the eastern region of India including West Bengal, Jharkhand, Bihar, Odisha and Assam. As on March 31, 2025, we service our general trade channel with over 28 C&F agents, 9 super stockists and 972 distributors, catering to over 70,000 retail outlets.

- Additionally, Company is constantly striving to add new distribution partners to its network. The number of distributors of our Company has increased from 814 as on March 31, 2023 to 972 as on March 31, 2025.

Company Plans to Grow the distribution network and our business-to-consumer (B2C) operations to deepen and expand our geographical presence.

- Company aims to deepen our business-to-consumer (B2C) operations and expand our presence across our existing geographical markets to consolidate our existing position and grow our business in new markets. Currently, Company’s focus geographical market extends across West Bengal, Jharkhand, Bihar, Odisha and Assam.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 614.77 | 765.25 | 855.15 |

| Net Profit | 27.1 | 26.9 | 35.4 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Ganesh Consumer Products Ltd | 10 | 9.74 | 33.05 | 15.81% | 61.62 |

| Patanjali Foods Ltd | 2 | 35.94 | 50.15 | 11.96% | 300.36 |

| AWL Agri Business Ltd | 1 | 9.44 | 27.15 | 13.12% | 71.91 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 22nd September 2025 |

| Issue Closes on | 24th September 2025 |

| Issue Price | Rs.306 -322 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 46 Shares |

| Minimum Investment | Rs.14,812 |

| Issue Constitutes | 31.14% |

| Issue Size | Rs.408.8 cr ($45 million ) |

| Market Cap | Rs.1300 cr ($ 146 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 40,37267 (Rs.130 cr) |

| Equity Shares Offered (OFS) | 86,58,333(Rs. 278 cr) |

| Total Equity Shares Offered (Fresh + OFS) | 1,26,95,600 (Rs.408.8 cr) |

| Equity Shares Prior to the Issue | 3,63,73,259 |

| Equity Shares after the Issue | 4,04,10,526 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 9.74 | 33.05 | 15.81% | 61.62 | 0.22 |

Also Read: Complete List of NSE/BSE Holidays List>>

Important Dates:

| Finalization of Basis of Allotment | on or Before 25th September 2025 |

| Initiation of Refunds | on or Before 26th September 2025 |

| Credit of Equity Shares: | on or Before 26th September 2025 |

| Listing Date: | on or Before 29th September 2025 |

| Company Contact Info: |

|---|

| Ganesh Consumer Products Limited 88, Burtolla Street, Kolkata, 700 007, West Bengal, India Telephone: +9133 4015 7900 Email: info@ganeshconsumer.com Website: www.ganeshconsumer.com |

| Registrar to the Issue: |

|---|

| MUFG Intime India Pvt Ltd C-101, 1st Floor, 247 Park L B S Marg, Vikhroli West Mumbai – 400 083, Maharashtra, India Telephone: +91 810 811 4949 Email: ganeshconsumer.ipo@in.mpms.mufg.com Website: www.in.mpms.mufg.com |

| Check IPO Allotment Status: |

|---|

MUFG Link InTime Website (Click on the below Link)https://MUFG linkintime.co.in/IPO_Allotment_Check |