About the Company:

About the Company:

Vikran Engineering Ltd is one of the fast-growing Indian Engineering, Procurement and Construction (EPC) company in terms of revenue growth over FY23-25, compared to the average industry growth estimates.

Company has a diversified project portfolio, with majority revenue from energy and water infrastructure verticals.

Company provides end to- end services from conceptualisation, design, supply, installation, testing and commissioning on a turnkey basis and has presence across multiple sectors including power, water, and railway infrastructure.

Within the power sector, Company has presence in both- power transmission and power distribution. In the water sector, company’s projects include underground water distribution and surface water extraction, overhead tanks, and distribution networks.

Company also has experience in Solar EPC of ground mounted solar projects and smart metering.Also, as a part of railway projects we undertake 132 kV traction substation projects and underground EHV cabling projects.

Company has experience of executing EPC projects with some of our projects being completed either ahead of schedule or within the contractual time periods. As of June 30, 2025, company have successfully completed 45 projects across 14 states with a total executed contract value of Rs.1919.9 crores.

Company’s Order Book:

As of June 30, 2025, Company 44 ongoing projects across 16 states, aggregating orders of Rs.5120.2 crores, of which Order Book of Rs.2442.4 crores.

Company’s Clients:

Company’s clients in the government sector include NTPC Limited, Power Grid Corporation of India Limited, South Bihar Power Distribution Co. Ltd., North Bihar Power Distribution Co. Ltd., Transmission Corporation of Telangana Limited, Madhya Pradesh Power Transmission Company Limited, Madhya Pradesh Madhya Kshetra Vidyut Vitran Company Limited, District Water and Sanitation Mission (PHED) and State Water and Sanitation Mission (SWSM).

Company’s Projects cover the following infrastructure business verticals:

Power Transmission and Distribution: Company undertakes the construction of high-voltage transmission lines up to 765 kV, substations up to 400 kV (both Air Insulated Substations (AIS) and Gas Insulated Substations (GIS)), and power distribution networks. We have also executed 30,000 smart metering connections under this vertical.

Water Infrastructure: Company provides turnkey solutions for water infrastructure projects such as surface and underground drinking water projects.Our water infrastructure includes wide range of services such as design, supply, erection of intake water treatment plant and overhead services reservoir.

Company undertakes the project of supply of drinking water through tube well and overhead services reservoir upto house connections primarily in rural areas. The project scope also includes the supply and lying of ductile iron pipes under multi village scheme under “Jal Jeevan Mission”.

Railway Infrastructure: company is also involved in the railway infrastructure sector, particularly in railway electrification. Company has successfully completed projects involving overhead electrification and signalling systems.

Also, as a part of railway electrification projects OHE 25kV, 50 Hz AC railway electrification project, 220 kV underground EHV cable work and construction of 132 kV transmission line and 132 kV railway traction substations projects.

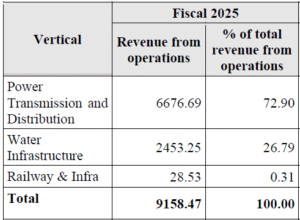

Details of contribution to revenue from operations by each vertical is set out below: (Amount in millions)

Management Team:

- Mr. Rakesh Ashok Markhedkar (Designation: Chairman and Managing Director)

- Mr. Avinash Ashok Markhedkar (Designation: Whole- Time Director)

Objectives of the Issue:

Offer For Sale: (Rs.51 cr)

- Company will not receive any proceeds from the Offer for Sale. The Selling Shareholders will be entitled to their respective portion of proceeds of the Offer for Sale.

Fresh issue: (Rs.721 cr)

- Funding working capital requirements of our Company.

- General corporate purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding working capital requirements of our Company |

541 cr |

Positives for the company:

One of the fast-growing engineering, procurement and construction (“EPC”) companies, with timely execution of power transmission and distribution and water infrastructure sector.

- Company is one of the fast-growing Indian Engineering, Procurement and Construction (EPC) company in terms of revenue growth over FY23-25, compared to the average industry growth estimates and the peer set considered.

Diversified Order Book across business verticals and consistent financial performance.

- In our industry, the Order Book holds importance as it represents the estimated contract value of the unexecuted portion of a company’s existing assigned EPC contracts and provides visibility of future revenues.

- Company’s Order Book is diversified across business verticals including power transmission and distribution, water infrastructure, and railway infrastructure. Further, we have presence in all the power transmission and distribution segments, which helps our Order Book to remain diversified within the power sector as well.

Selectively expanding our geographical footprint globally.

- Company started operations from Madhya Pradesh and gradually expanded over time to complete projects in 14 states in India.

- As of June 30, 2025, company is currently executing 44 projects across 16 states in India. As part of our growth strategy, we aim to expand into infrastructure EPC projects in the private sector and explore international markets, particularly in African and Middle Eastern regions.

Company is Expanding the EPC portfolio into other EPC sectors.

- To enhance the business growth, Company plans to expand our presence in various verticals, including railways and metros. This is expected to diversify our offerings, reduce dependency on existing services, and target higher-margin opportunities with lower working capital requirements.

- Over the coming years, company will focus on current projects while exploring opportunities to broaden our portfolio into other EPC sectors. For instance, we are set to expand into the solar EPC industry by undertaking turnkey projects for solar PV systems up to 100MWp and balance of system projects for solar power plants up to 300MWp.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 529.1 | 791.4 | 922.36 |

| Net Profit | 42.8 | 74.8 | 77.8 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Vikran Engineering Ltd | 1 | 4.35 | 22.29 | 16.63% | 25.49 |

| Bajel Projects Ltd (Subsidiary of Bajaj Electricals) |

2 | 1.34 | 158.75 | 2.32% | 57.63 |

| Kalpataru Projects International Ltd | 2 | 35.53 | 34.68 | 8.77% | 378.80 |

| Techno Electric & Engineering Company Ltd |

2 | 37.19 | 40.17 | 11.31% | 321.55 |

| SPML Infra Ltd | 2 | 7.61 | 36.79 | 6.22% | 107.43 |

| KEC International Ltd | 2 | 21.80 | 35.71 | 10.67% | 200.88 |

| Transrail Lighting Ltd | 2 | 25.72 | 30.73 | 17.36% | 140.11 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 26th August 2025 |

| Issue Closes on | 27th August 2025 |

| Issue Price | Rs.97 |

| Face Value | Rs.1 |

| Retail Category Allocation | 35% |

| Minimum Lot | 148 Shares |

| Minimum Investment | Rs.14,356 |

| Issue Constitutes | 35.45 % |

| Issue Size | Rs.771 cr ($ 88 million ) |

| Market Cap | Rs.2177 cr ($ 250 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 7,43,29,896 (Rs.721 cr) |

| Equity Shares Offered (OFS) | 52,57,732 (Rs.51 cr) |

| Total Equity Shares Offered (Fresh + OFS) | 7,95,87,628 (Rs.771 cr) |

| Equity Shares Prior to the Issue | 15,01,32,780 |

| Equity Shares after the Issue | 22,44,62,676 (Rs.2177 cr) |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 4.35 | 22.29 | 16.63% | 25.49 | 0.58 |

Important Dates:

| Finalization of Basis of Allotment | on or Before 1st September 2025 |

| Initiation of Refunds | on or Before 2nd September 2025 |

| Credit of Equity Shares: | on or Before 2nd September 2025 |

| Listing Date: | on or Before 3rd September 2025 |

| Company Contact Info: |

|---|

| Vikran Engineering Ltd 401, Odyssey I.T. Park, Road No. 9, Wagle Industrial Estate, Thane (W) – 400604, Maharashtra. Tel: +91-22-62638263 Email: companysecretary@vikrangroup.com Website: www.vikrangroup.com |

| Registrar to the Issue: |

|---|

| Bigshare Services Private Limited Pinnacle Business Park, Office No S6-2, 6th floor, Mahakali Caves Rd, Next to Ahura Centre, Andheri East, Mumbai, Maharashtra 400093 Tel: +91-22-62638200 E-mail: ipo@bigshareonline.com Website: https://www.bigshareonline.com |

| Check IPO Allotment Status: |

|---|

Bigshare: http://www.bigshareonline.com/IPO/Allotment

|