About the Company:

About the Company:

Mangal Electrical Industries Ltd specialize in processing transformer components, including transformer laminations, CRGO slit coils, amorphous cores, coil and core assemblies, wound and toroidal cores, and oil-immersed circuit breakers.

Company also trade CRGO and CRNO coils, as well as amorphous ribbons. Additionally, we manufacture transformers and customized products for the power infrastructure industry. Our transformer range spans from single-phase 5 KVA to three-phase 10 MVA units.

Company also offers EPC services for setting up electrical substations, serving the power sector. We have five production facilities in Rajasthan with an aggregate production capacity for (i) 16,200 MT for CRGO, (ii) 10,22,500 KVA for transformers and (iii) 75,000 units for ICB and (iv) 2,400 MT for Amorphous units per annum.

Company’s customer mix primarily include governmental and municipal utilities such as Ajmer Vidyut Vitran Nigam Limited and Jaipur Vidyut Vitran Nigam Limited and private sector energy producers such as Voltamp Transformers Limited and Western Electrotrans Private Limited.

As for the last three Fiscals 2025, 2024 and 2023, Company has exported transformer components to Netherlands, United Arab Emirates, Oman, United States of America, Italy and Nepal.

Company Order Book:

Company’s order book is an important indicator of the future revenue potential of our business, comprising the estimated revenues from the unexecuted portions of all our existing contracts as of a particular date. As on June 30, 2025, order book for all our business segments stood at Rs.294 crores.

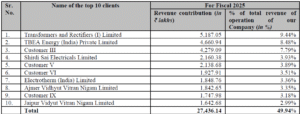

Company’s Revenue from Top 10 Customers:

Management Team:

- Mr. Rahul Mangal (Designation: Chairman and Managing Director)

- Mr. Ashish Mangal (Designation: Non-Executive Director)

Objectives of the Issue:

Fresh issue: (Rs.400 cr)

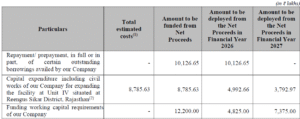

- Repayment/prepayment, in full or in part, of certain outstanding borrowings availed by our Company.

- Capital expenditure including civil works of our Company for expanding the facility at Unit IV situated at Reengus Sikar District, Rajasthan to optimize space usage and increase storage capacity.

- Funding working capital requirements of our Company.

- General corporate purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Repayment/ prepayment, in full or in part, of certain outstanding borrowings availed by our Company | 101.26 |

| Capital expenditure including civil works of our Company for expanding the facility at Unit IV situated at Reengus Sikar District, Rajasthan | 87.85 |

| Funding working capital requirements of our Company | 122 |

Proposed schedule of implementation and deployment of Net Proceeds:

Positives for the Company:

Company Plans to Expand manufacturing capacity at our existing facilities.

- Company is committed to expanding its manufacturing capacity at our existing facilities to meet the growing demand for transformer components across various sectors, including energy, industrial, and infrastructure.

- The expansion will be achieved through targeted investments in advanced production technology and infrastructure upgrades, allowing for greater output and operational efficiency. By optimizing the use of current space, reconfiguring plant layouts, and introducing additional production lines, we aim to significantly increase the output at our current facilities.

Company plans to Expand the existing product portfolios.

- Company plans to diversifying our existing product portfolio by introducing a broader range of innovative transformer solutions tailored to meet the diverse needs of our customers across various sectors, including renewable energy, infrastructure, and industrial applications.

- This strategic expansion will position us as a one-stop solution provider, enabling us to better serve our clients and address the growing demand for high-efficiency transformers.

Negatives for the Company:

Revenue concentration in select states.

- Approximately 71% of Company’s revenue in the Financial Year 2024–2025 is concentrated in just three states—Gujarat, Rajasthan, and Uttar Pradesh. This high reliance on a few geographical markets introduces a degree of concentration risk, particularly if there are region-specific regulatory changes, market slowdowns, or unforeseen disruptions.

Lower contribution from transformer manufacturing.

- At present, the majority of Company’s revenue comes from processing components used in transformers, while the actual manufacturing of transformers contributes only about 23% to the total revenue in the Financial Year 2025. This relatively low share limits our Company’s ability to fully benefit from the expanding demand in the transformer industry.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 357.81 | 452.12 | 551.39 |

| Net Profit | 24.73 | 20.94 | 47.30 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Mangal Electrical Industries Ltd |

10 | 23.08 | 24.30 | 34.14% | 79.10 |

| Vilas Transcore Ltd | 10 | 14.58 | 36.48 | 15.27% | 117.68 |

Important Dates:

| Finalization of Basis of Allotment | on or Before 25th August 2025 |

| Initiation of Refunds | on or Before 26th August 2025 |

| Credit of Equity Shares: | on or Before 26th August 2025 |

| Listing Date: | on or Before 28th August 2025 |

| Company Contact Info: |

|---|

| Mangal Electrical Industries Ltd C-61, C-61 (A&B), Road No. 1-C, V. K. I. Area, Jaipur 302 013, Rajasthan, India. Telephone: +91141-4036113 E-mail: compliance@mangals.com; Website: https://mangals.com/index.html |

| Registrar to the Issue: |

|---|

| Bigshare Services Private Limited Office No S6-2, 6th Floor, Pinnacle Business Park Mahakali Caves Road, next to Ahura Centre Andheri (East) Mumbai – 400 093 Maharashtra, India Tel: +91 22 62638200 E-mail: ipo@bigshareonline.com Website: https://www.bigshareonline.com |