About the Company:

About the Company:

Manba Finance Ltd is a Non-Banking Financial Company-Base Layer (NBFC-BL) providing financial solutions for New two wheeler (2Ws,) three wheeler (3Ws), electric two wheeler (EV2Ws), electric three wheeler (EV3Ws), Used Cars, Small Business Loans and Personal Loans with an AUM size of more than Rs.900 cr as on March 31, 2024.

About 97.90% of company’s loan portfolio comprises of New Vehicle Loans with an average ticket size (ATS) of around Rs.80,000 for two-wheeler loans and an average ticket size (ATS) of around Rs.1,40,000 for three-wheeler loans.

Company provides financial solutions to our target customers who are looking for a quick turnaround time (TAT) for loan sanction and disbursement.

Company’s target customers are mainly salaried and self-employed.

Company is based out of Mumbai, Maharashtra and operate out of 66 Locations connected to 29 branches across six (6) states in western, central and north India.

Company has established relationships with more than 1,100 Dealers, including more than 190 EV Dealers, across Maharashtra, Gujarat, Rajasthan, Chhattisgarh, Madhya Pradesh and Uttar Pradesh.

Company has recently expanded the loan portfolio to Used Car Loans, Small Business Loans and Personal Loans and we intend to leverage our existing network to further penetrate the market with our new products.

Company customizes the offerings as per each of these categories of customers and prepare tailor-made schemes to attract them to avail loans from us.

Company normally funds upto 85% of the purchase price (on road price) of the vehicle proposed to be acquired by the customer and prefer the customer to contribute the balance.

Types of Loans offered by the Company:

- New Vehicle Loans.

- Used Car Loans.

- Small Business Loans (Manba Vyapaar Loans).

- Personal Loans.

Company’s Network:

Company commenced the business in 1998 as a NBFC from Mumbai, Maharashtra and scaled up our operations from 2009 by way of growth in number of branches and locations across states. Company’s Branches are located in urban, semi-urban and metropolitan cities and towns which serves the surrounding rural areas.

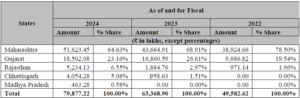

Company has established relationships with more than 1,100 Dealers, including more than 190 EV Dealers across the following states: (image)

Company’s Source of Funding:

Company secures funding from diversified sources including term loans and cash credit facilities from public sector banks, private sector banks, small finance banks & other financial institutions and PTC and issuance of privately placed listed and unlisted NCDs to meet our capital requirements.

As of Fiscals 2024, 2023 and 2022, Company’s total borrowings were Rs. 752.2 cr, Rs.595.9 cr and Rs.394.3 cr, respectively. Company’s average cost of borrowings as of Fiscals 2024, 2023 and 2022 was 11.98%, 11.19% and 11.61%, respectively.

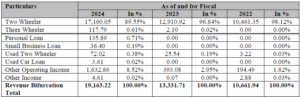

Company’s Product Wise Revenue: (in Lakhs)

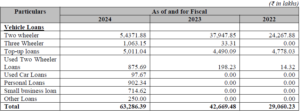

Break-up of loans given by the Company is as follows: (in Lakhs)

Company’s State wise Loan Portfolio and total number of Vehicle Loan Portfolio:

Management Team:

- Mr. Manish Kiritkumar Shah (Designation: Managing Director)

- Mr. Nikita Manish Shah (Designation: Whole Time Director and Head – Business Development)

Objectives of the Issue:

Fresh Issue: (Rs.150.84 cr)

- Augmentation of our capital base to meet our future capital requirements

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Augmentation of our capital base to meet our future capital requirements | 138.77 cr |

Positives for the Company:

Established relationships with the Dealers.

- Company commenced the business in 1998 as a NBFC from Mumbai, Maharashtra and scaled up our operations from 2009 with vehicle financing.

- Company has established strong relationships with more than 1,100 Dealers, including more than 190 EV Dealers, across Maharashtra, Gujarat, Rajasthan, Chhattisgarh, Madhya Pradesh and Uttar Pradesh, where our employees are present at the dealer’s premises to attend to the prospective customer who comes for the purchase of a 2Ws/3Ws/2EVWs/3EVWs.

- Dealers prefer to refer and recommend finance companies who have the ability and capacity to turnaround the process from the loan origination to sanction and disbursement in the fastest possible time.

Company plans to increase penetration in existing markets and diversifying into new markets.

- Company intends to further penetrate our existing markets by not only offering 2Ws/3Ws/EV2Ws/EV3Ws loans but also diversify our loan portfolio to new products such as Used Car Loans, Small Business Loans and Personal Loans to customers.

- Company has gained significant knowledge and experience of the markets and customers in general in the six (6) states that we operate. The knowledge and experience gathered over the years of serving in these markets offer us an advantage in further penetrating these markets into areas and districts not yet serviced by us.

Company has recently began operations in Uttar Pradesh.

- Company has begun our operations in the city of Lucknow, Uttar Pradesh and will slowly move towards other parts of Uttar Pradesh and have already appointed senior personnel for this expansion and formed a team.

- Company has successfully tried and tested this model in other states and we believe that our strategy can be replicated successfully in Uttar Pradesh as well. Company believes that with an increased portfolio of product offerings we will be able to increase our penetration in existing markets and also expand our reach to newer markets like Uttar Pradesh.

Ability to expand to new underpenetrated geographies.

- Company has scaled up our operations from 2009 with vehicle financing and are now present in 66 Locations spread across six (6) states in western, central and north India. We initially focused ourselves on Maharashtra and after gaining the necessary knowledge and experience, we expanded our operations to other states like Gujarat, Rajasthan, Chhattisgarh, Madhya Pradesh and Uttar Pradesh.

Technology driven and scalable operating model with quick Turn Around Time (TAT) for loan processing.

- Company has established systems and processes from sales to risk management and collections. Most of the systems and processes are in-house or are licensed from known service providers. This enables better monitoring and quality control of our services and helps in reducing the turnaround time for loan approvals, sanction and disbursement.

- Company has organised each of our functions into separate activities and deployed the necessary technology, manpower and systems to ensure smooth running of all operations in a collective and conducive environment.

Company offers Quick processing of Loans.

- About 97.90% of Company’s loan portfolio comprises of New Vehicle Loans with an average ticket size (ATS) of Rs.80,000 in principal amount for two-wheeler loans and an average ticket size (ATS) of around Rs. 1,40,000 for three-wheeler loans.

- More than 85% of Company’s New Vehicle Loans are sanctioned on same day of the application, out of which 60% are sanctioned within one (1) minute of the receipt of the application through our sales teams.

- Company’s systems provide and analysed LTV, CIBIL score, vehicle model, residence type, customer category and other eligibility parameters already set-up in our systems in quick time enabling a faster approval process followed up with disbursement of the funds to the Dealer.

- Company offers various schemes to customers and Dealers almost the entire year and especially during the festival season. Company offers New Vehicles Loans for a tenure ranging from 6 months to 48 months.

Financials of the Company:

| (in Crores) | FY 22 | FY 23 | FY 24 |

|---|---|---|---|

| Revenue | 106.61 | 133.31 | 191.63 |

| Net Profit | 9.74 | 16.5 | 31.4 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Manba Finance Ltd | 10 | 8.34 | 14.39 | 15.66% | 53.26 |

| Baid Finserv Ltd | 2 | 1.08 | 13.65 | 7.75% | 13.89 |

| Arman Financial Services Ltd | 10 | 195.00 | 8.57 | 21.36% | 775.70 |

| MAS Financial Services Ltd | 10 | 15.31 | 18.13 | 14.25% | 108.71 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 23rd September 2024 |

| Issue Closes on | 25th September 2024 |

| Issue Price | Rs.114- 120 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 125 Shares |

| Minimum Investment | Rs.15,000 |

| Issue Constitutes | 25.02 % |

| Issue Size | Rs.150.84 cr ($ 18 million ) |

| Market Cap | Rs.602.78 cr ($ 72 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 1,25,70,000 (Rs.150.84 cr) |

| Equity Shares Prior to the Issue | 3,76,69,410 |

| Equity Shares after the Issue | 5,02,39,410 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 8.34 | 14.39 | 15.66 | 53.26 |

Also Read: Complete List of NSE/BSE Holidays List>>

| Should You Subscribe or Not ? (Markets Guruji’s View) |

|---|

| Manba Finance Ltd is a Non-Banking Financial Company-Base Layer (NBFC-BL) offering financial solutions for new two-wheelers (2Ws), three-wheelers (3Ws), electric two-wheelers (EV2Ws), electric three-wheelers (EV3Ws), used cars, small business loans, and personal loans.

As of March 31, 2024, the company has an asset under management (AUM) exceeding Rs.900 crore. Approximately 97.90% of the company’s loan portfolio consists of new vehicle loans, with an average ticket size (ATS) of Rs.80,000 for two-wheelers and ₹1,40,000 for three-wheelers. Manba Finance caters to both salaried and self-employed customers who seek a quick turnaround time (TAT) for loan sanction and disbursement. Headquartered in Mumbai, Maharashtra, the company operates from 66 locations across six states, connected by 29 branches. Manba Finance has built strong relationships with over 1,100 dealers, including more than 190 electric vehicle dealers, in Maharashtra, Gujarat, Rajasthan, Chhattisgarh, Madhya Pradesh, and Uttar Pradesh. The company is expanding its footprint in existing markets while diversifying into new ones, with a recent entry into Uttar Pradesh, India’s largest state. Investors may find long-term prospects and potential for significant listing gains. |

Important Dates:

| Finalization of Basis of Allotment | on or Before 26th September 2024 |

| Initiation of Refunds | on or Before 26th September 2024 |

| Credit of Equity Shares: | on or Before 27th September 2024 |

| Listing Date: | on or Before 30th September 2024 |

| Company Contact Info: |

|---|

| Manba Finance Ltd IT/ ITES Building, Plot No. A-79, Road No. 16, Wagle Estate, Thane 400 604, Maharashtra, India. Tel: +91 22 6234 6598 E-mail Id: investorrelation@manbafinance.com Website: www.manbafinance.com |

| Registrar to the Issue: |

|---|

| Link Intime India Private Limited C-101, 1st Floor, 247 Park, L.B. S. Marg, Vikhroli (West) Mumbai 400 083 Maharashtra, India Telephone: +91 81081 14949 E-mail: manbafinanceipo@linkintime.co.in Website: www.linkintime.co.in |