About the Company:

About the Company:

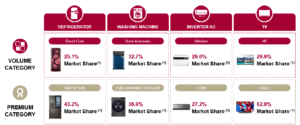

LG Electronics India Ltd has been the number one player in major home appliances and consumer electronics (excluding mobile phones) in India for the six months ended June 30, 2025, CY2024, CY2023 and CY2022 as per the market share (in terms of value) in the offline channel.

Company is also market leaders in India across multiple product categories including washing machines, refrigerators, panel televisions, inverter air conditioners, and microwaves, based on the market share (in terms of value) in the offline channel (which represents approximately 78% and 77% of the major home appliances and consumer electronics market in India.

Company was incorporated in 1997 as a wholly owned subsidiary of LG Electronics, which is the leading single-brand global home appliances player in terms of market share by revenue in CY2024.

Company offered one of the widest product portfolios amongst leading home appliances and consumer electronics players (excluding mobile phones) in India.

Company sell products to B2C and B2B consumers in India and outside India. We also offer installation services, and repairs and maintenance services for all our products.

Company’s Business Segments:

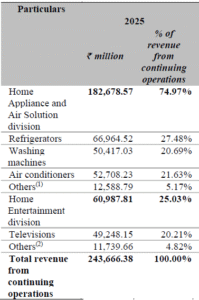

Company’s Revenue from various Segments:

(1) Others include water purifiers, air purifiers, dishwashers, microwave ovens, vacuum cleaners and compressors.

(2) Others include media display and audiovisual products, including monitors, interactive displays, and information systems, projectors, wireless speakers and earbuds.

Company’s Distribution and Service Network:

Company operates the largest distribution network among leading home appliances and consumer electronics players in India as of June 30, 2025.

Company’s distribution network spans across urban and rural India through 35,640 B2C touch points for the three months ended June 30, 2025. Company serviced consumers through a dedicated team 463 B2B trade partners as of June 30, 2025, and also had a team of 286 employees engaging in customer service as of June 30, 2025.

Company’s after Sales Network:

Complementing our distribution network, we operate one of the largest after-sales service networks in terms of number of after-sales service center touchpoints among leading home appliances and consumer electronics players in India as of June 30, 2025.

Company provides installation and repairs/maintenance services through 1,006 service centers across urban and rural India, supported by 13,368 engineers and four call centers, as of June 30, 2025.

Company’s Marketshare by Product Category:

Company’s Marketshare by Volume Category and Premium Category:

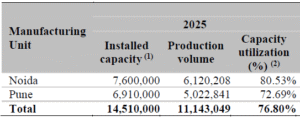

Company’s Manufacturing Facilities:

Company has two advanced manufacturing units located in Noida (the “Noida Manufacturing Unit”) and Pune (the “Pune Manufacturing Unit”).

In Fiscal 2025 and in the three months ended June 30, 2025, Company had an installed capacity of 14,510,000 products at our Noida and Pune Manufacturing Units collectively.

In addition to manufacturing products, company also manufacture several key components, such as compressors and motors, at our Noida Manufacturing Unit and Pune Manufacturing Unit, giving us greater control over the product development process, product quality, costs and supply and delivery time.

Company’s manufacturing units in Pune and Noida operated at an aggregate capacity utilization rate of 76.80% for Fiscal 2025.

Company’s Installed Capacity & Capacity Utilization:

Company is Expanding by adding a Third Manufacturing facility:

Company is constructing a third manufacturing unit in Andhra Pradesh to expand our manufacturing capacity. Company is investing Rs.5000 crores for a new manufacturing facility in Sri City in Andhra Pradesh.

The new manufacturing unit is expected to become operational by Fiscal 2027, initially focusing on the production of air conditioners and air conditioner compressors, followed by the manufacturing of washing machines and refrigerators in the forthcoming years.

Management Team:

- Mr. Hong Ju Jeon (Designation: Managing Director)

- Mr. Dongmyung Seo (Designation: Whole-time Director and Chief Financial Officer)

Objectives of the Issue:

Offer For Sale: (Rs.11,607 cr)

- Company will not receive any proceeds from the Offer for Sale. The Selling Shareholders will be entitled to their respective portion of proceeds of the Offer for Sale.

Positives for the Company:

- Leading market share in the home appliances and consumer electronics industry in India with #1 market share across key product categories.

- Shaping consumer experience with pan-India distribution and after-sales service network.

- Operational efficiency through strong manufacturing capabilities and localized supply chain.

- Parentage of LG Electronics, which is the leading single-brand global home appliances player in terms of market share by revenue in CY 2024 and strong LG brand.

- Capital efficient business with high growth and profitability.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 | Upto 30th June 25 |

|---|---|---|---|---|

| Revenue | 20,108.5 | 21,557.1 | 24,630.6 | 6,337.3 |

| Net Profit | 1348.0 | 1511.0 | 2203.3 | 513.2 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| LG Electronics India Ltd | 10 | 32.46 | 35.12 | 37.13% | 87.42 |

| Havells Ltd | 1 | 23.48 | 64.14 | 17.63% | 133.05 |

| Voltas Ltd | 1 | 25.43 | 52.68 | 12.76% | 197.66 |

| Whirlpool Ltd | 10 | 28.30 | 43.53 | 9.09% | 314.52 |

| Blue Star Ltd | 2 | 28.76 | 65.59 | 19.27% | 149.19 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 7th October 2025 |

| Issue Closes on | 9th October 2025 |

| Issue Price | Rs.1080-1140 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 13 Shares |

| Minimum Investment | Rs.14,820 |

| Issue Constitutes | 15% |

| Issue Size | Rs.11,607 cr ($1.3 billion ) |

| Market Cap | Rs.77,380 cr ($8.7 billion ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (OFS) | 10,18,15,859 |

| Equity Shares Prior to the Issue | 67,87,72,392 |

| Equity Shares after the Issue | 67,87,72,392 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 32.46 | 35.12 | 37.13% | 87.42 | 0.00 |

Important Dates:

| Finalization of Basis of Allotment | on or Before 10th October 2025 |

| Initiation of Refunds | on or Before 13th October 2025 |

| Credit of Equity Shares: | on or Before 13th October 2025 |

| Listing Date: | on or Before 14th October 2025 |

| Company Contact Info: |

|---|

| LG Electronics India Ltd 16th – 20th Floor, C-001, Tower D, KP Tower, Sector 16B, Noida 201 301, Uttar Pradesh, India. Telephone: +91 120 651 6700 Email: cgc.india@lge.com Website: www.lg.com/in/ |

| Registrar to the Issue: |

|---|

| KFin Technologies Limited Selenium Tower B, Plot No.31-32 Gachibowli, Financial District Nanakramguda, Serilingampally Hyderabad 500 032 Telangana, India. Tel: +91 40 6716 2222 E-mail:lgelectronics.ipo@kfintech.com Website: www.kfintech.com |

| Check IPO Allotment Status: |

|---|

KfinTech Website (Click on the below Link)http://kfintech/IPO/Allotment_Status |