About the Company:

About the Company:

Glottis Ltd offers multi-modal integrated logistics solutions, which include end to end transportation solutions through ocean, air and road logistics services.

Company delivers end-to-end logistics solutions with multimodal capabilities across verticals to optimize the movement of goods across geographies including (i) ocean freight forwarding (project cargo load and full container load, import as well as export); (ii) air freight forwarding (import as well as export); (iii) road transportation; along with other ancillary services, including warehousing, storage, cargo handling, third-party logistics (“3PL”) services and custom clearance, among others.

Company has handled ~112,146 TEUs of imports through ocean during the Fiscal 2025.

Company has a track record of mobilising large volumes of cargo for our customers engaged in various industries.

Company’s ability to mobilise higher volumes is on account of our widespread network of international freight forwarding agencies, who provide us insights on available carriers, route management and globally prevalent freight forwarding rates, which enhances our capabilities of committing carrier spaces in advance at competitive rates, thereby offering commitment of delivery.

Company’s track record of handling ~112,146 TEUs of imports through ocean during the Fiscal 2025, coupled with our widespread network of international freight forwarding agencies, has given us the required experience and knowledge of executing orders for the renewable energy industry, which involve transportation of sensistive as well as specialized products.

Company’s capabilities of handling complex cargo and ability to mobolise volumes has given us a competitive edge, and has garnered industry recognition.

With global footprint and expertise in handling complex supply chains, Glottis serves customers across multiple industries, with particular emphasis on energy infrastructure and renewable energy projects.

Company’s revenue streams in the renewable energy industry come from leading power producers in renewable energy landscape, encompassing solar, wind, hydro, and other clean energy sources.

Beyond power generation companies, our freight management services also extend to Intermediaries throughout the renewable energy supply chain, including solar glass manufacturers, manufacturers of energy components such as, solar cells, solar wafers, trackers, among others, and consolidators of intelligent power systems designed to mitigate high nonrenewable energy costs, etc.

Company’s PAN India Network:

Company operates PAN-India through a network of 8 branch offices in New Delhi, Gandhidham, Kolkata, Mumbai, Tuticorin, Coimbatore, Bengaluru and Cochin; and registered and corporate offices in Chennai to cover major transportation hubs.

Company has over the years also spread our operations across countries, including but not limited to, Europe, North America, South America, Africa, Middle East and Asian Countries through our arrangements with local freight forwarding agents in such countries.

Growing logistics, and freight needs has led to our Company’s expansion into new markets like Europe, African, Central & South America, Canada, Mediterranean, Middle East and Australia.

Company’s Customers:

For the Fiscals 2025, 2024 and 2023, company served total 1,908, 1,662 and 1,513 customers across one hindred and twenty five (125), one hundred (100) and eighty seven (87) countries, respectively.

Additionally, through our Group Companies, namely, Continental Shipping & Consulting Pte Ltd, Continental Worldwide Shipping Service LLC and Continental Shipping & Consulting Vietnam Co. Ltd, our Company has established local presence in Singapore, United Arab Emirates and Vietnam.

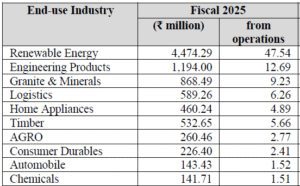

Company’s Revenue from Various Industry Segments:

Management Team:

- Mr. Ramkumar Senthilvel (Designation: Managing Director)

- Mr. Kuttappan Manikandan (Designation: Managing Director)

Objectives of the Issue:

Offer For Sale: (Rs.147 cr)

- Company will not receive any proceeds from the Offer for Sale. The Selling Shareholders will be entitled to their respective portion of proceeds of the Offer for Sale.

Fresh Issue: (Rs.160 cr)

- Funding of capital expenditure requirements of our Company towards purchase of commercial vehicles and containers.

- General Corporate Purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding capital expenditure requirements of our Company, towards purchase of commercial vehicles and containers | 132.5 cr |

Positives for the Company:

Glottis delivers end-to-end logistics solutions with multimodal capabilities across verticals to optimize the movement of goods across geographies.

- Company integrates services of our Intermediaries and our in-house infrastructure, to offer start to finish logistical solutions to our customers. Company’s service offerings coupled with the capabilities of our Intermediaries enable us to offer assistance in geographically dispersed locations, while modifying operating volumes, optimising loads and maintaining flexibility in handling capacity variations depending on our customers’ requirements.

One of the leading freight forwarding player operating in the Renewable Energy Industry.

- Over the years Company has developed a specialised customer base, comprising power generation and component manufacturing companies engaged in the renewable energy industry. Through our intermediary base, we have harnessed capabilities of executing complex orders which involve transportation of fragile and specialised products across the supply chain in this industry. Company’s capability of offering logistical solutions coupled with wide intermediary network has resulted in a competitive advantage for us.

Wide network of Intermediaries coupled with optimum utilisation of our asset portfolio.

- As of August 31, 2025, Company had a network of Two hundred and fifty six (256) overseas agents, One hundred and twenty four (124) shipping lines and agencies, Seventy seven (77) transporters, Fifty Nine (59) custom house agents, Sixteen (16) airlines, Thirty two (32)consol agents and container freight stations among others, in our portfolio, built on longstanding relationships.

- Company believes the strategic decision of outsourcing key functions of ocean freight forwarding operations has enabled us to mobilize larger volumes of cargo, reduce the cost and time involved in executing an order and increase its margins by increasing the revenue sources through key Intermediaries.

Scaled multimodal logistics operations with capabilities of handling diverse projects.

- With two decades of operational experience, we have developed internal intelligence related to trade flows and volumes. Owing to the diverse and longstanding experience of our Company, we have executed projects which involved supply chain of critical and sensitive components such as, solar panels, solar cells, glass panels, sophisticated equipment for manufacturing solar cells, etc.

Longstanding relationship with diverse set of customers across industries.

- Company has established longstanding relationship with certain of our customers over the years. Company undertakes import as well as export of cargo, for leading power producers in renewable energy landscape, solar glass manufacturers, manufacturers of energy components and manufacturers engaged in the timber, glass, consumer durables, agriculture, amongst others.

- Company’s repeat customers have grown from 834 in Fiscal 2023 to 871 in Fiscal 2025. Additionally, based on customers’ referrals, we also extend our existing product offerings to new customers engaged in similar industries, which in turn helps us to increase our customer base and venture into new geographies.

Widespread International Presence.

- Company has operations across regions including, Asia, North America, Europe, South America, Africa and Australia and during the Fiscals 2025, 2024 and 2023, our operations were spread across one hindred and twenty five (125), one hundred (100) and eighty seven (87), respectively.

- Additionally, through our Group Companies, namely, Continental Shipping & Consulting Pte Ltd, Continental Worldwide Shipping Service LLC and Continental Shipping & Consulting Vietnam Co. Ltd, our Company has established local presence in Singapore, United Arab Emirates and Vietnam. This expansive reach allows us to establish a market presence, nurture customer relationships, and drive sustainable growth.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 478.7 | 499.3 | 942.5 |

| Net Profit | 22.4 | 30.9 | 56.1 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Glottis Limited | 2 | 7.02 | 18.37 | 56.98% | 12.32 |

| Allcargo Logistics Ltd | 2 | 1.75 | 17.95 | 2.03% | 24.65 |

| Transport Corporation of India Ltd |

2 | 53.43 | 25.60 | 19.42% | 279.65 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 29th September 2025 |

| Issue Closes on | 1st October 2025 |

| Issue Price | Rs.120-129 |

| Face Value | Rs.2 |

| Retail Category Allocation | 35% |

| Minimum Lot | 114 Shares |

| Minimum Investment | Rs.14,706 |

| Issue Constitutes | 25.75% |

| Issue Size | Rs.307 cr ($ 35 million) |

| Market Cap | Rs.1192 cr ($ 133 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 1,24,03,100 (Rs.160 cr) |

| Equity Shares Offered (OFS) | 1,13,95,640 (Rs.147 cr) |

| Total Equity Shares Offered (Fresh + OFS) | 2,37,98,740 (Rs.307 cr) |

| Equity Shares Prior to the Issue | 8,00,00,000 |

| Equity Shares after the Issue | 9,24,03,100 (Rs.1192 cr) |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 7.02 | 18.37 | 56.98% | 12.32 | 0.22 |

Also Read: Complete List of NSE/BSE Holidays List>>

Important Dates:

| Finalization of Basis of Allotment | on or Before 3rd October 2025 |

| Initiation of Refunds | on or Before 6th October 2025 |

| Credit of Equity Shares: | on or Before 6th October 2025 |

| Listing Date: | on or Before 7th October 2025 |

| Company Contact Info: |

|---|

| Glottis Ltd Plot Number 164, 13th Cross Street Defence Officers Colony, Ekkattuthangal, Nandambakkam, Chennai – 600 032, Tamil Nadu, India Telephone: +91 44 4266 8366 E-mail: info@glottislogistics.in Website: www.glottislogistics.in |

| Registrar to the Issue: |

|---|

| KFin Technologies Limited Selenium Tower B, Plot No. 31 and 32 Financial District, Nanakramguda Serilingampally, Hyderabad – 500 032, Telangana, India. Telephone: +91 40 6716 2222/180 030 94001 Email: glottisltd.ipo@kfintech.com Website: www.kfintech.com |

| Lead Manager to the Issue: |

|---|

| Pantomath Capital Advisors Private Limited Pantomath Nucleus House, Saki Vihar Road Andheri East, Mumbai – 400 072 Maharashtra, India. Telephone: 180 088 98711 Email: glottis.ipo@pantomathgroup.com Website: www.pantomathgroup.com |

| Check IPO Allotment Status: |

|---|

KfinTech Website (Click on the below Link)http://kfintech/IPO/Allotment_Status |