About the Company:

About the Company:

Amanta Healthcare Ltd is a pharmaceutical company engaged in developing, manufacturing and marketing a diverse range of sterile liquid products – parenteral products, being packed in plastic container with Aseptic Blow-Fill-Seal (“ABFS”) and Injection Strech Blow Moulding (“ISBM”) technology.

Company manufactures large volume parenterals (“LVPs”) and small volume parenterals (“SVPs”) in six therapeutic segments. In addition to that, company also manufacturers

medical devices.

Company manufactures fluid therapy – (IV Fluid), formulations, diluents, ophthalmic, respiratory care and irrigation solutions in therapeutic segment and products like irrigation, first-aid solution, eye lubricants etc. in medical device segment.

Company offers wide range of closure systems, such as nipple head, twist-off, leur-lock and screw types and container fill-volume ranging from 2ml to 1000 ml.

Company markets the products through three strategic business units namely (a) national sales, (b) international sales and (c) product partnering with various foreign and Indian pharmaceutical companies.

Company manufactures diverse generics product portfolio of over 45 products and market them under our own brands in the Indian market through a network of over 320 distributors and stockists.

Company’s Product Portfolio:

Company’s international sales business covers, advanced market countries and emerging market countries. As on the date company has a portfolio of 47 products registered across 120 international jurisdictions. Company’s product partnering business include commercial large-scale manufacturing of generic products.

Company’s Product Segments:

- Fluid therapy – (IV Fluid).

- Formulations.

- Diluents and Injectables.

- Ophthalmic.

- Respiratory care.

- Irrigation solutions in therapeutic segment.

Company’s Exports:

Company sell products in various countries including the Africa, Latin America, UK and the Rest of the world. Company’s products are currently registered with 19 countries and have a compliance track record with a range of regulatory regimes across these markets.

During the Fiscal 2025, Company exported branded products to 21 countries. In product partnering, Company undertakes manufacturing for various pharmaceutical companies.

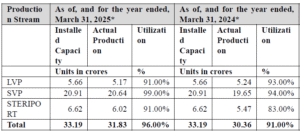

Company’s Installed Capacity,Capacity Utilization & Actual Production:

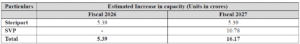

Estimated Increase in capacity after Proposed Capacity Expansion:

Management Team:

- Mr. Bhavesh Patel (Designation: Chairman and Managing Director)

- Mr. Nimesh Patel (Designation: Non-Executive Director)

Objectives of the Issue:

Fresh Issue: (Rs.126 cr)

- Funding capital expenditure requirements for civil construction work and towards purchase of equipment, plant and machinery for setting up new manufacturing line of SteriPort at Hariyala, Kheda, Gujarat.

- Funding capital expenditure requirements towards civil construction work, purchase of equipment, plant and machinery for setting up new manufacturing line for SVP at Hariyala, Kheda, Gujarat.

- General corporate purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding capital expenditure requirements for civil construction work and towards purchase of equipment, plant and machinery for setting up new manufacturing line of SteriPort at Hariyala, Kheda, Gujarat |

70 cr |

| Funding capital expenditure requirements towards civil construction work, purchase of equipment, plant and machinery for setting up new manufacturing line for SVP at Hariyala, Kheda, Gujarat |

30.13 cr |

Positives for the Company:

Well established manufacturer of pharmaceutical formulations with diverse product portfolio and diverse market.

- Incorporated in the year 1994, Company has a well diversified product portfolio with product group of six therapeutic segments viz; fluid therapy, formulations, diluents, ophthalmic, respiratory care and irrigation solutions.

- In terms of container offerings, company offers wide range of closure systems, such as nipple head, twist-off, leur-lock and screw types and container fill-volume ranging from 2ml to 1000 ml. As on the date company has a a portfolio of 47 products registered across 120 international jurisdictions. The diverse product portfolio is giving us consistency and sustainability in business.

Wide Domestic and International Marketing Network.

- Company has sales, marketing and distribution capabilities in India. Company has over 320 distributors/stockist’ network supported by sales team of approximately 96 people. We primarily sell our products to distributors in India, who in turn supplies to Hospital and Nursing Homes, etc.

Expansion of Manufacturing Capacities.

- Company manufactures LVPs and SVPs in six therapeutic segments. We operate in three product group segments viz; (1) Large Volume Parenteral, Nipple Head (Single Port), (2) SteriPort (Two Ports) and (3) Small Volume Parenteral.

- The margin profile of all the three businesses are different. The margin profile ranges from 20% to more then 60% depending upon the product.

- Company is experiencing short supply in these segments and intends to expand the capacity in these two segments. By expanding our manufacturing capacity in these areas, we will be able to expand our product offering.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 262.69 | 281.60 | 276.09 |

| Net Profit | (-2.11) | 3.63 | 10.50 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Amanta Healthcare Ltd | 10 | 3.71 | 33.96 | 10.89% | 33.43 |

| Denis Chem Lab Ltd | 10 | 5.82 | 15.92 | 9.49% | 61.33 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 1st September 2025 |

| Issue Closes on | 3rd September 2025 |

| Issue Price | Rs.120 -126 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35 % |

| Minimum Lot | 19 Shares |

| Minimum Investment | Rs.14,994 |

| Issue Constitutes | 25.75 % |

| Issue Size | Rs.126 cr ($ 15 million ) |

| Market Cap | Rs.490 cr ($ 55 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 1,00,00,000 (Rs.126 cr) |

| Equity Shares Prior to the Issue | 2,88,29,351 |

| Equity Shares after the Issue | 3,88,29,351 (Rs.490 cr) |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 3.71 | 33.96 | 10.89% | 33.43 | 2.02 |

Also Read: Complete List of NSE/BSE Holidays List>>

Important Dates:

| Finalization of Basis of Allotment | on or Before 4th September 2025 |

| Initiation of Refunds | on or Before 8th September 2025 |

| Credit of Equity Shares: | on or Before 8th September 2025 |

| Listing Date: | on or Before 9th September 2025 |

| Company Contact Info: |

|---|

| Amanta Healthcare Limited 8th Floor, Shaligram Corporates, C.J. Marg, Ambli, Ahmedabad – 380058 Gujarat, India Telephone: 079 67777600 E-mail: cs@amanta.co.in Website: www.amanta.co.in |

| Registrar to the Issue: |

|---|

| MUFG Intime India Pvt Ltd (formerly Link intime India Pvt Ltd) C-101, 1st Floor, 247 Park, L.B.S. Marg Vikhroli (West), Mumbai 400 083, Maharashtra Telephone: +91 8108114949 E-mail: amantahealthcare.ipo@linkintime.co.in Investor grievance e-mail: amantahealthcare.ipo@linkintime.co.in Website: www.linkintime.co.in |

| Check IPO Allotment Status: |

|---|

MUFG Link InTime Website (Click on the below Link)https://MUFG linkintime.co.in/IPO_Allotment_Check |