About the Company:

About the Company:

Advance Agrolife Ltd is an agrochemical company engaged in manufacturing a wide range of agrochemical products that support the entire lifecycle of crops.

Company’s products are designed for use in the cultivation of major cereals, vegetables, and horticultural crops across both agri-seasons (Kharif and Rabi) in India.

As on the date of March 31st 2025, Company has received four hundred and ten (410) generic registrations comprising of three hundred and eighty (380) Formulation Grade registration and thirty (30) Technical Grade registration for the agrochemicals.

Company’s major product portfolio includes insecticides, herbicides, fungicides, plant growth regulators. Company also manufactures other agrochemical products such as micro-nutrient fertilizers and bio fertilizers.

Company’s products are primarily sold domestically through direct sales to corporate customers on B-2-B basis, across the country, particularly in 19 states and 2 union territories.

In addition to serving domestic market, Company’s products were also exported to 7 countries including UAE, Bangladesh, China (including Hong Kong), Turkey, Egypt, Kenya and Nepal during the Fiscal 2025,Fiscal 2024 and Fiscal 2023.

Company Mainly Supplies to B2B Customers:

Company supplyies products to corporate customers who market them under their own brand names and their sales strategies. These customers utilize their distribution networks and market presence to ensure widespread availability of our agrochemical solutions.

By leveraging their reach and expertise, our products effectively serve farmers and agricultural businesses across diverse regions, supporting crop protection and growth on a large scale.

Some of our marquee corporate customers include DCM Shriram Limited, IFFCO MC Crop Science Private Limited, Indogulf Cropsciences Limited, Mankind Agritech Private Limited, HPM Chemicals And Fertilizers Limited, ULink AgriTech Private Limited, amongst other.

As of for Fiscal 2025, Fiscal 2024, and Fiscal 2023, we served 849, 1,194 and 1,135 corporate customers, respectively.

In Fiscal 2025, out of the total 849 corporate customers, 94 have been associated with us for more than 3 years, demonstrating the strength, reliability, and longevity of our business relationships.

Company’s ability to maintain long-term partnerships is a testament to our consistent product quality, customer-centric approach, and commitment to innovation in the agrochemical industry.

Company’s History:

Company commenced our commercial operations in 2002 with small-scale production, initially focused on mixing micro-nutrient fertilizers. During the period from 2002 to 2007, we gained significant experience in agrochemical industry and market dynamics, which laid the foundation for our expansion.

In the year 2012, Company further diversified our formulation portfolio with the introduction of WP (Wettable Powder), WDG (Water Dispersible Granules), EC (Emulsifiable Concentrate), and SC (Suspension Concentrate).

Post September 2024, Company expanded our portfolio to include Technical grade agrochemical products by implementing a backward integration strategy, transitioning Manufacturing Facility I to focus solely on Technical-grade manufacturing, while shifting all formulation grade production to Manufacturing Facility II and Manufacturing Facility III.

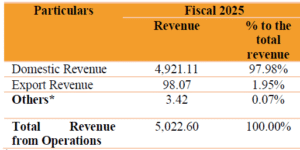

Company’s Revenue from Domestic and Exports: (₹ in millions except for percentages)

Management Team:

- Mr. Om Prakash Choudhary (Designation: Chairman and Managing Director)

- Mr.Kedar Choudhary (Designation:Whole-time Director)

Objectives of the Issue:

Fresh Issue: (Rs.192 cr)

- Funding Working Capital requirements of our Company.

- General Corporate Purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding Working Capital requirements of our Company | 135 cr |

Positives for the Company:

Established, integrated manufacturing setup at strategic location.

- Company has three Manufacturing Facilities spread across a cumulative 49,543.35 sq.m of land at Jaipur, Rajasthan, having total annual installed capacity of 89,900 MTPA.

- Company’s Manufacturing Facilities are equipped with advanced machinery and equipment that enable the production of both Technicals and Formulations while optimizing operational efficiency.

- The automation and technology integrated into our Manufacturing Facilities reduce manual intervention, enhance consistency, and productivity in manufacturing. This streamlined approach allows us to maintain cost efficiency, improve output quality, and scale production effectively to meet market demand.

Diversified product portfolio of agrochemical products.

- Company is a B2B agrochemical company engaged in the manufacturing of a diverse range of agrochemical products that support the entire crop lifecycle. Company’s products are used in the cultivation of major cereals, vegetables, and horticultural crops across both Kharif and Rabi seasons in India.

- Company manufactures both Technical Grade and Formulation Grade agrochemical through our integrated Manufacturing Facilities. Company’s product portfolio includes insecticides, herbicides, fungicides, plant growth regulators and other products such as micro-nutrient fertilizers and bio fertilizers.

Established customer base and strong relationships.

- Several of our customers have been associated with our Company for over 10 years. Company’s customers include agrochemical companies such as DCM Shriram Ltd, IFFCO MC Crop Science Private Ltd, Indogulf Cropsciences Ltd, Crystal Crop Protection Ltd, Mankind Agritech Private Ltd, HPM Chemicals And Fertilizers Ltd, ULink AgriTech Private Ltd, amongst other.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 397.9 | 457.2 | 502.8 |

| Net Profit | 14.8 | 24.7 | 25.6 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Advance Agrolife Ltd | 10 | 5.70 | 17.54 | 29.11 | 22.42 |

| Dharmaj Crop Guard Ltd | 10 | 10.68 | 34.60 | 9.24% | 116.70 |

| Insecticides India Ltd | 10 | 48.38 | 16.99 | 13.55% | 372.74 |

| PI Industries Ltd | 10 | 109.44 | 34.29 | 17.58% | 668.22 |

| Sharda Cropchem Ltd | 10 | 33.74 | 30.33 | 12.85% | 277.21 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 30th September 2025 |

| Issue Closes on | 3rd October 2025 |

| Issue Price | Rs.95 -100 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 150 Shares |

| Minimum Investment | Rs.15000 |

| Issue Constitutes | 30% |

| Issue Size | Rs.192.85 cr ($21.66 million ) |

| Market Cap | Rs.642.85 cr ($ 72 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 1,92,85,720 (Rs.192.85 cr) |

| Equity Shares Prior to the Issue | 4,50,00,000 |

| Equity Shares after the Issue | 6,42,85,720 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 5.70 | 17.54 | 29.11 | 22.42 | 0.80 |

Also Read: Complete List of NSE/BSE Holidays List>>

Important Dates:

| Finalization of Basis of Allotment | on or Before 6th October 2025 |

| Initiation of Refunds | on or Before 7th October 2025 |

| Credit of Equity Shares: | on or Before 7th October 2025 |

| Listing Date: | on or Before 8th October 2025 |

| Company Contact Info: |

|---|

| Advance Agrolife Ltd 301, 3rd floor & 140-B Pandit, TN Mishra Marg Nirman Nagar, Jaipur – 302 019, Rajasthan, India. Telephone: +91 0141 4810 126 E-mail: cs@advanceagrolife.com Website: www.advanceagrolife.com |

| Registrar to the Issue: |

|---|

| KFin Technologies Limited Selenium Tower-B, Plot No. – 31 and 32 Financial District Nanakramguda, Serilingampally Hyderabad – 500 032, Telangana, India Telephone: +91 40 6716 2222 / 1800 309 4001 Email: advance.ipo@kfintech.com Website: www.kfintech.com |

| Check IPO Allotment Status: |

|---|

KfinTech Website (Click on the below Link)http://kfintech/IPO/Allotment_Status |