About the Company:

About the Company:

Regaal Resources Ltd is one of the largest manufacturers of maize based specialty products in India, in terms of crushing capacity, with a total installed crushing capacity of 750 tonnes per day (TPD).

Company is headquartered in Kolkata and our manufacturing plant with zero liquid discharge (ZLD) maize milling plant (Manufacturing Facility) spread across 54.03 acres is located in Kishanganj, Bihar.

Company caters to domestic and international customers across diverse industries including food products, paper, animal feed, and adhesives.

Company’s products are sold across various states in India directly to the end customers and through distributors and dealer. Company’s products are also sold overseas in countries such as Bangladesh,

Nepal, and Malaysia.

Company commenced our operations in 2018 with an installed capacity of 180 TPD. Company has over the years augmented our operations and undertaken multiple capacity expansions.

In Fiscal 2025, Company increased our capacity further with the installation of a starch dryer. As on May 31, 2025, our installed crushing capacity was 750 TPD.

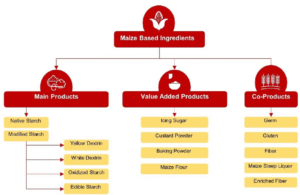

Products Manufactured by the Company:

- Native maize starch and modified starch – a plant-based natural starch that is produced from maize.

- Co-products – includes gluten, germ, enriched fiber and fiber.

- Value added products – food grade starches such as maize flour, icing sugar, custard powder and baking powder.

Company’s products range may broadly be classified as set out in the schematic representation below:

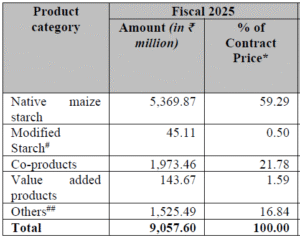

Company’s Revenue From Various Product Categories:

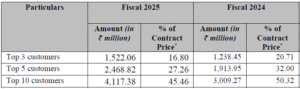

Company’s Revenue from Top Customers:

Strategic Location of Company’s Manufacturing Facilities:

Company has strategically situated our plant in Bihar since it is one of India’s major hubs for maize cultivation.

- According to F&S Report, we are the first maize milling company to have established its plant in Kishanganj district of Bihar which is the maize catchment area and has a bumper harvest in Rabi season (i.e. an increase of in maize production from 91,680 MT in Fiscal 2023 to 417,511 MT in Fiscal 2024) which ensures smooth supply of maize during the season.

- The strategic location of our Manufacturing Facility is heightened by the proximity to our market for the sale of our products i.e., the East and North India, and according to F&S Report, our key export markets i.e. Nepal and Bangladesh – the Nepal and Bangladesh borders are only 24 kms and 235 kms by road from our Manufacturing Facility.

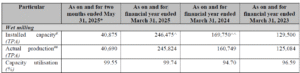

Company’s Installed Capacity and Capacity Utilization:

Company’s Storage Facilities:

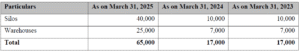

Company’s Manufacturing Facility also comprises large warehouses and 4 humidity-controlled storage silos of 10,000 MT each for storage of maize. As on May 31, 2025, we had an aggregate storage capacity of 65,000 tonnes of maize.

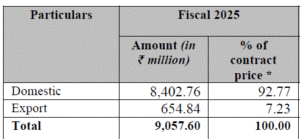

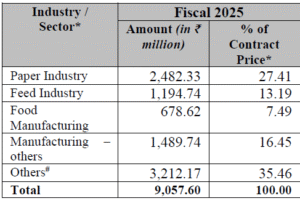

Company’s Revenue from Domestic Markets and Exports:

Company’s Revenue from operations across various end-user industries:

Set out below are details of Company’s Raw material storage capacity (in metric ton):

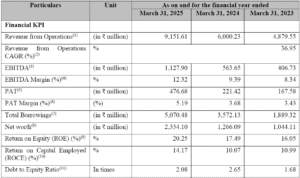

Company’s Key Financial Parameters:

Management Team:

- Mr. Anil Kishorepuria Anil Kishorepuria (Designation: Chairman and Managing Director)

- Mr. Karan Kishorepuria (Designation: Whole Time Director)

Objectives of the Issue:

Offer For Sale: (Rs.96 cr)

- Company will not receive any proceeds from the Offer for Sale. The Selling Shareholders will be entitled to their respective portion of proceeds of the Offer for Sale.

Fresh Issue: (Rs.210 cr)

- Repayment and/ or pre-payment, in full or in part, of our certain outstanding borrowings availed by our Company.

- General Corporate Purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Repayment and/ or pre-payment, in full or in part, of our certain outstanding borrowings availed by our Company |

159 cr |

Positives for the Company:

Strategic locational advantage of our Manufacturing Facility close to raw material and end consumption markets.

- Company is strategically located in the heart of one of India’s largest maize growing hubs i.e. in Kishanganj district in Bihar, which is one of the top 3 maize cultivating states in India.This unique advantage is afforded to us due to the strategic location of our unit in Bihar is accentuated by the fact that we are the only maize milling plant in Bihar.

Diversified portfolio of products catering to wide range of industries and well positioned to take advantage of growing industry trends.

- Company is amongst the top 10 largest maize milling companies in India, in terms of crushing capacity with a total installed crushing capacity of 750 TPD. With our revenue growing at a CAGR of

36.95% between Fiscal 2023 and Fiscal 2025, we are one of the fastest growing maize based specialty products manufacturers in India among our identified peers. - Company commenced our operations with a key product viz., native maize starch and certain co-products viz., gluten, germ, enriched fiber etc. Over the years, we have diversified our product range and manufacture an assorted range of maize based speciality products.

Increasing our manufacturing capacity by undertaking brownfield expansion.

- As on May 31, 2025, our installed crushing capacity was 750 TPD. Company has made an application before the Bihar State Pollution Control Board to increase our installed capacity from 750 TPD to 1,650 TPD.

- Company’s current Manufacturing Facility is situated on land admeasuring 54.03 acres in Kishanganj, Bihar, which has sufficient unused land available for expansion. Company proposes to increase the capacity of our Manufacturing Facility to capitalise on anticipated growth in our end-user industries.

Deleveraging Company’s balance sheet by paring debt.

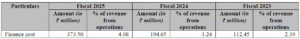

- Company intends to reduce our borrowings. As on June 30, 2025, company’s aggregate total outstanding borrowings were Rs.5,61.1 crores. In Fiscal 2025, Fiscal 2024, and Fiscal 2023, our finance costs, based on our Restated Financial Information, were as follows.

- As part of company’s strategic initiatives, we intend to deleverage our Company and pare our outstanding debt to enable us to inter alia reduce our finance costs and improve our cash flows, which will in turn allow us to utilise such cash flows and funds towards business operations and to execute our other strategies.

- Company propose to utilise a sum of Rs.1,59 crores from the Fresh Issue Proceeds towards paring our outstanding debt obligations.

Expanding company’s basket of modified starch product.

- Currently, company manufacture variety of modified starch products such as white dextrin and yellow dextrin, oxidized starch and edible starch. Company proposes to add modified starch products such as cationic starch, carboxyl methyl starch, Indian Pharmacopoeia grade starch and pregel starch.

- Modified starch is a crucial and useful ingredient found in manufacturing ready-to-eat food products.

Increasing domestic reach and international footprint.

- Company is currently catering to a few customers in South Indian states such as Andhra Pradesh and Telangana.

- Company proposes to expand our domestic reach and expand our presence in South India. As a part of business strategy, Company proposes to increase its presence in South India by further expanding in Andhra Pradesh and Telangana, initially, and gradually in other states viz. Tamil Nadu and Karnataka.

- The key end-user industries for our maize based specialty products in India are paper, textile, pharmaceutical, F&B and adhesive. The South Indian states of Andhra Pradesh, Karnataka, Tamil Nadu and Telangana are home to a large number of companies which operate in quite a few of the aforementioned industries.

Company Plans to Develop white labelling business.

- In Fiscal 2025, Company undertook manufacturing of certain products such as maize flour, baking powder, custard powder and icing sugar. The specifications for the manufacturing were provided by the customer which also provided the necessary artwork for white labelling.

- With the proposed expansion of our Manufacturing Facility, our continuous focus on quality and standardized processes we anticipate that we will be able to cater to this aspect of the business on an increasing scale.

Financials of the Company:

| (in Crores) | FY 23 | FY 24 | FY 25 |

|---|---|---|---|

| Revenue | 488.6 | 601.0 | 917.5 |

| Net Profit | 16.7 | 22.1 | 47.6 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Regaal Resources Ltd | 5 | 6.05 | 16.85 | 20.25% | 28.66 |

| Sanstar Ltd | 2 | 2.58 | 36.46 | 7.03% | 34.18 |

| Gujarat Ambuja Exports Ltd |

1 | 5.44 | 20.22 | 8.30% | 65.46 |

| Gulshan Polyols Ltd | 1 | 3.95 | 44.56 | 4.02% | 87.07 |

| Sukhjit Starch and Chemicals Ltd |

5 | 12.79 | 13.51 | 7.36% | 173.82 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 12th August 2025 |

| Issue Closes on | 14th August 2025 |

| Issue Price | Rs.102 |

| Face Value | Rs.5 |

| Retail Category Allocation | 35% |

| Minimum Lot | 144 Shares |

| Minimum Investment | Rs.14,688 |

| Issue Constitutes | 29.20 % |

| Issue Size | Rs.306 cr ($ 35 million ) |

| Market Cap | Rs.1048 cr ($ 120 million ) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 2,05,88,235 (Rs.210 cr) |

| Equity Shares Offered (OFS) | 94,12,000 (Rs.96 cr) |

| Total Equity Shares Offered (Fresh + OFS) | 3,00,00,235 (Rs.306 cr) |

| Equity Shares Prior to the Issue | 8,21,35,940 |

| Equity Shares after the Issue | 10,27,24,175 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) | Debt Equity Ratio (D/E) |

|---|---|---|---|---|

| 6.05 | 16.85 | 20.25% | 28.66 | 2.08 |

Also Read: Complete List of NSE/BSE Holidays List>>

| Should You Subscribe or Not ? (Markets Guruji’s View) |

|---|

| Regaal Resources Ltd is among the largest manufacturers of maize-based specialty products in India, with a significant installed crushing capacity of 750 tonnes per day (TPD). Headquartered in Kolkata, the company operates a state-of-the-art Zero Liquid Discharge (ZLD) maize milling plant spread across 54.03 acres in Kishanganj, Bihar. This strategic location offers proximity to both raw material sources and key consumption markets, enabling efficient operations and cost advantages.

The company serves a diverse clientele across industries such as food products, paper, animal feed, and adhesives. Its products are marketed throughout India directly to end customers as well as via distributors and dealers. Internationally, Regaal Resources exports to Bangladesh, Nepal, and Malaysia, reflecting its growing global presence. With a diversified product portfolio, the company is well-positioned to capitalize on emerging industry trends. It is also undertaking a brownfield expansion to increase capacity, aiming to meet the rising demand for modified starch products. Additionally, Regaal Resources is focused on strengthening its financial position by reducing debt and expanding both its domestic reach and export footprint. Given its strong market positioning, growth plans, and sector potential, investors may consider applying for both short-term listing gains and long-term wealth creation opportunities. |

Important Dates

| Finalization of Basis of Allotment | on or Before 18th August 2025 |

| Initiation of Refunds | on or Before 19th August 2025 |

| Credit of Equity Shares: | on or Before 19th August 2025 |

| Listing Date: | on or Before 20th August 2025 |

| Company Contact Info: |

|---|

| Regaal Resources Ltd 6th Floor, D2/2, Block-EP & GP, Sector-V, Kolkata, West Bengal, India, 700091; Tel: 033 3522 2405; E-mail: cs@regaal.in; Website: www.regaalresources.com |

| Registrar to the Issue: |

|---|

| MUFG Intime India Private Limited (formerly Link Intime India Private Limited) C-101, 247 Park, 1st Floor, LBS Marg, Vikhroli (West), Mumbai – 400 083, Maharashtra, India Tel: +91 810 811 4949 E-mail: regaalresources.ipo@in.mpms.mufg.com Website: www.in.mpms.mufg.com |

| Check IPO Allotment Status: |

|---|

MUFG Link InTime Website (Click on the below Link)https://MUFG linkintime.co.in/IPO_Allotment_Check |